Introduction

Venture capital investment has become increasingly important in the agricultural industry, where innovation and technological advancements have the potential to significantly impact the production, efficiency, and sustainability of food systems. In this article, we will explore the world of venture capital in agriculture, including its definition, characteristics, and how it works. We will also examine the role of venture capital in agriculture, the benefits and challenges of investing in this industry, and the most successful venture capital firms that have invested in agriculture.

Understanding Venture Capital

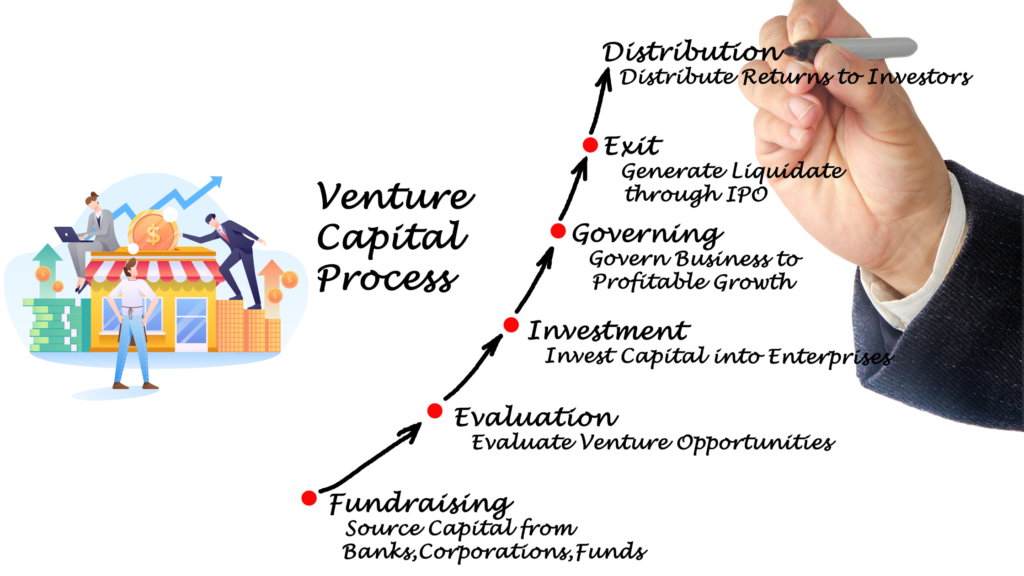

Venture capital is a type of private equity investment that is typically made to support high-growth potential startups and early-stage companies. Venture capital firms invest in companies with the expectation of high returns, and often provide not only financial support, but also guidance and expertise. Venture capital is typically characterized by high risk, high reward, and long-term investment horizons.

How venture capital works can vary, but typically, venture capital firms raise funds from institutional investors such as pension funds, endowments, and family offices. These funds are then used to make investments in companies with high growth potential, typically in exchange for an ownership stake in the company. The goal is for the venture capital firm to help the company grow and ultimately sell their ownership stake for a profit.

Venture Capital in Agriculture: An Overview

Venture capital has played a significant role in the development of the agricultural industry in recent years. Venture capital investment in agriculture has focused on a wide range of areas, including precision agriculture, sustainable farming practices, and food technology.

The impact of venture capital investment in agriculture has been significant, with new technologies and innovations improving operational efficiency, reducing waste, and increasing production yields. Venture capital firms are investing in agriculture through a variety of methods, including direct investment in startups and early-stage companies, as well as through funding accelerators and incubators.

The Benefits of Venture Capital in Agriculture

- Access to Capital: One of the primary benefits of venture capital investment is that it provides agricultural startups with access to much-needed capital. This capital can be used to fund research and development, purchase equipment and supplies, and hire staff. By providing this capital, venture capital firms can help agricultural startups grow and scale their businesses more quickly than they would be able to otherwise.

- Increased Innovation: Venture capital investment can also drive innovation in the agriculture industry. By funding innovative startups, venture capital firms can help develop new technologies, processes, and products that can improve the efficiency and sustainability of agriculture.

- Improved Operational Efficiency: Another benefit of venture capital investment is that it can help agricultural startups improve their operational efficiency. With access to capital, startups can invest in technologies and equipment that can streamline their operations and reduce costs. This can help them compete more effectively in the marketplace.

- Expansion of Markets: Venture capital investment can also help agricultural startups expand their markets. With access to capital, startups can invest in marketing and advertising campaigns that can help them reach new customers and increase sales.

- Increased Production: Finally, venture capital investment can help agricultural startups increase production. By investing in new technologies and equipment, startups can increase the efficiency of their operations, which can lead to higher yields and greater production.

Overall, the benefits of venture capital investment in agriculture are clear. By providing startups with access to capital, driving innovation, improving operational efficiency, expanding markets, and increasing production, venture capital firms can have a significant impact on the agriculture industry.

The Challenges of Venture Capital in Agriculture

While venture capital investment in agriculture presents numerous benefits, it also comes with its own unique set of challenges. Some of the main challenges include:

- The risk involved: Agriculture is a risky business, and investing in agriculture can be especially risky. Factors like climate change, natural disasters, and pests can all affect crop yields, which in turn can impact the profitability of agriculture businesses.

- Lack of awareness about venture capital in agriculture: Many agriculture entrepreneurs are not familiar with venture capital funding or may not understand how it works. This can make it challenging for venture capital firms to identify potential investment opportunities.

- Regulatory challenges: Agriculture is a heavily regulated industry, and there are many regulations that venture capital firms must comply with when investing in agriculture businesses.

- Limited exit options: Agriculture businesses typically have long investment horizons, which can make it difficult for venture capital firms to exit their investments. This can be especially challenging for firms that have a limited amount of capital to invest and need to generate returns quickly.

Famous Venture Capital Firms in Agriculture

Several venture capital firms have made significant investments in agriculture over the years. Here are a few examples:

- AgFunder has gained popularity due to its investments in precision agriculture, which utilizes advanced technologies like drones, sensors, and machine learning to optimize crop yields and reduce waste. The firm has also invested in startups focused on improving food safety through innovative technologies.

- Cultivian Sandbox is known for its investments in sustainable food and agriculture, which aligns with the growing consumer demand for ethically and environmentally responsible food production. The firm has invested in startups focused on developing alternative proteins, which can help reduce the environmental impact of meat production. Additionally, Cultivian Sandbox has invested in startups developing novel crops that can help farmers adapt to climate change.

- S2G Ventures is a popular venture capital firm due to its focus on investing in sustainable agriculture and food systems. The firm has invested in startups that are working to reduce food waste, develop plant-based proteins, and utilize vertical farming to increase crop yields while reducing the environmental impact of agriculture. S2G Ventures also has a strong focus on impact investing, aiming to support startups that can make a positive impact on the world.

Largest Venture Capital Firms in Agriculture

While there are many venture capital firms that invest in agriculture, some of the largest and most influential include:

- Flagship Pioneering has a portfolio of over 100 companies, with many of them focused on agriculture and food systems. The firm is known for its groundbreaking research and development, and for being a pioneer in the field of biotechnology. Flagship Pioneering invests in companies that aim to solve major global challenges, such as food security and climate change, through science and technology.

- Kleiner Perkins is a well-known venture capital firm that has been around for over 50 years. The firm has made investments in high-profile technology companies like Google, Amazon, and Twitter, but they have also invested in agriculture. Kleiner Perkins has made investments in companies that focus on precision agriculture, such as Farmers Business Network, which provides farmers with tools to improve their yields and reduce their costs. The firm has also invested in food safety companies like Clear Labs, which uses genomic sequencing to detect pathogens in food.

- Andreessen Horowitz is a venture capital firm that has made investments in a variety of industries, including agriculture. The firm has invested in indoor farming companies like Plenty, which uses vertical farming technology to grow crops indoors. They have also invested in food delivery companies like DoorDash, which helps farmers connect with customers and deliver their products directly to their doors. Additionally, the firm has invested in biotechnology companies like Pivot Bio, which uses microbes to reduce the need for synthetic fertilizers in agriculture.

What Venture Capital Firms Look for in Agriculture

capital firms are looking for companies that have the potential for significant growth and profitability. In agriculture, they are specifically looking for companies that can improve efficiency, reduce costs, and increase yields. Some key criteria that venture capital firms look for in agriculture include:

- Scalability: Venture capital firms are looking for companies that have the potential for significant growth. They want to invest in companies that can scale quickly and have the potential to become large, profitable businesses.

- Innovation: Venture capital firms are looking for companies that are developing innovative solutions to problems in the agriculture industry. They want to invest in companies that are pushing the boundaries of what is possible and developing new technologies that can improve efficiency, reduce costs, and increase yields.

- Management team: Venture capital firms are looking for companies that have a strong management team with experience in the agriculture industry. They want to invest in companies that have a clear vision for the future and a plan for how to achieve their goals.

- Market potential: Venture capital firms are looking for companies that are addressing a large and growing market. They want to invest in companies that have the potential to capture a significant share of the market and generate significant profits.

- Competitive advantage: Venture capital firms are looking for companies that have a competitive advantage over their rivals. They want to invest in companies that have developed unique technologies or business models that give them an edge in the market.

Overall, venture capital firms are looking for companies that have the potential for significant growth and profitability, and that are developing innovative solutions to problems in the agriculture industry. They want to invest in companies that have a clear vision for the future and the ability to execute on that vision.

Which Stage Venture Capital Funds a Startup in Agriculture

There are several stages of venture capital funding, including seed funding, early-stage funding, and late-stage funding. In agriculture, early-stage funding is typically the most common stage for venture capital investment. This is because many agriculture businesses are still in the development phase

Regulatory Environment for Venture Capital Firms in Agriculture

The regulatory environment for venture capital firms in agriculture is complex and varies depending on the country or region. In the United States, the Securities and Exchange Commission (SEC) regulates venture capital firms through the Investment Advisers Act of 1940. This act requires venture capital firms to register with the SEC and provide certain disclosures about their business and investment strategies.

In addition to federal regulations, venture capital firms investing in agriculture are subject to a range of state and local regulations. These may include environmental regulations, zoning laws, and labor laws, among others.

Internationally, the regulatory environment for venture capital firms in agriculture can be even more complex, as regulations vary widely by country. This can make it difficult for venture capital firms to operate in multiple countries, as they must navigate a range of different regulatory frameworks.

Despite the challenges, venture capital firms have continued to invest in agriculture, driven by the potential for high returns and the opportunity to make a positive impact on the industry.

Key regulations and compliance requirements:

- SEC registration: Venture capital firms in the United States must register with the SEC and provide certain disclosures about their business and investment strategies.

- Environmental regulations: Venture capital firms investing in agriculture must comply with a range of environmental regulations, including those related to water use, waste disposal, and pesticide use.

- Labor laws: Venture capital firms investing in agriculture must comply with labor laws related to minimum wage, overtime pay, and working conditions, among others.

- Zoning laws: Venture capital firms investing in agriculture must comply with local zoning laws related to land use and development.

- Intellectual property laws: Venture capital firms investing in agriculture must navigate a range of intellectual property laws related to patents, trademarks, and copyrights, among others.

The role of government agencies in regulating venture capital in agriculture varies by country, but may include the SEC, the Department of Agriculture, and other regulatory bodies. These agencies play an important role in protecting investors, promoting transparency, and ensuring that venture capital firms comply with relevant regulations.

Despite the challenges of operating in a complex regulatory environment, venture capital firms have continued to invest in agriculture, driven by the potential for high returns and the opportunity to make a positive impact on the industry. As the agriculture industry continues to evolve, it is likely that venture capital will play an increasingly important role in shaping its future.

Where are Most Venture Capital Firms Located in Agriculture?

The geographic distribution of venture capital firms in agriculture varies widely depending on the region and country. In the United States, for example, venture capital firms investing in agriculture are primarily located in California, which is home to many of the largest agriculture technology companies and research institutions. Other states with significant venture capital investment in agriculture include New York, Massachusetts, and Texas.

Internationally, venture capital investment in agriculture is also concentrated in certain regions. In Europe, for example, the United Kingdom, Germany, and France are among the largest markets for venture capital investment in agriculture. In Asia, China, Japan, and India are emerging as major players in the agriculture technology space.

The location of venture capital firms in agriculture can have a significant impact on their investment strategies and the types of companies they target. For example, venture capital firms located in California may focus on companies developing new technologies for crop management, while firms located in the Midwest may focus on companies developing new equipment for harvesting and processing crops.

Location can also play an important role in building networks and relationships with other stakeholders in the agriculture industry, including farmers, research institutions, and government agencies. Venture capital firms with local knowledge and networks may be better positioned to identify promising investment opportunities and navigate regulatory challenges.

Can You Invest in Venture Capital Firms in Agriculture?

Venture capital firms typically raise funds from institutional investors, such as pension funds, university endowments, and wealthy individuals, to invest in startups and other high-growth businesses. While individual investors may not have direct access to these funds, there are a number of ways that they can indirectly invest in venture capital firms.

One option is to invest in a mutual fund or exchange-traded fund (ETF) that focuses on venture capital. These funds typically invest in a portfolio of venture capital funds and offer investors exposure to a diverse range of startups and high-growth businesses. However, it is important to note that these funds often come with high fees and may not be suitable for all investors.

Another option is to invest in a venture capital firm that is publicly traded. Some venture capital firms have gone public, offering investors the opportunity to invest in the firm itself rather than its underlying portfolio of startups. However, investing in a publicly traded venture capital firm comes with its own risks and challenges, and may not be appropriate for all investors.

Finally, some online platforms have emerged that allow individual investors to invest directly in startups and other high-growth businesses. These platforms typically allow investors to invest small amounts of money in a range of startups and may offer opportunities to invest alongside venture capital firms.

Conclusion

Venture capital investment has become an increasingly important source of funding for startups in the agriculture industry. By providing access to capital, venture capital firms can help startups to innovate, improve operational efficiency, expand their markets, and increase production.

However, venture capital investment in agriculture also comes with significant challenges, including the risk involved, the lack of awareness about venture capital in agriculture, regulatory challenges, and limited exit options.

Despite these challenges, venture capital firms continue to invest in the agriculture industry, driven by the potential for significant returns and the opportunity to make a positive impact on the world.

As the agriculture industry continues to evolve, it is likely that venture capital investment will play an increasingly important role in shaping its future. By supporting startups and other high-growth businesses, venture capital firms can help to drive innovation and promote sustainable agriculture practices, ultimately leading to a more resilient and prosperous industry.

Venture Capital In Agriculture FAQ

Can you invest in venture capital firms?

Generally, venture capital firms are not open to individual investors. Their investors are typically high net worth individuals, institutional investors, and other entities like pension funds and endowments.

Are venture capital firms regulated?

Yes, venture capital firms are subject to regulation by various government agencies, depending on the country they operate in. In the US, for example, venture capital firms are regulated by the Securities and Exchange Commission (SEC).

What do venture capital firms do?

Venture capital firms provide funding to startup companies and other early-stage businesses that have the potential for high growth. They typically invest in exchange for an ownership stake in the company and work closely with the company’s management team to help them grow and succeed.

Are venture capital firms publicly traded?

Most venture capital firms are not publicly traded. They are typically privately held and their shares are not available for purchase on public stock exchanges.

What are venture capitalist firms?

Venture capitalist firms are investment firms that specialize in providing funding to startup companies and other early-stage businesses. They typically invest in exchange for an ownership stake in the company and provide support and guidance to help the company grow and succeed.