Introduction

Are you in search of a distinctive investment opportunity promising remarkable returns? Look no further than hazelnut farm investing. While traditional investments often take the spotlight, hazelnut farms hold a hidden potential waiting to be explored.

With the global demand for hazelnuts on the rise, investing in this lucrative industry is a smart choice. In this guide, we will explore the myriad advantages of investing in hazelnut farms, from sustainability to profitability.

We’ll delve into market trends and hazelnut demand, offering a comprehensive understanding of why this investment should not be underestimated. Get ready to unveil the untapped potential of hazelnut farms and set course to secure your financial future.

The Growing Demand for Hazelnuts

Recent years have witnessed an exponential surge in hazelnut demand, fueled by various factors. One of the key drivers is the soaring popularity of hazelnut-based products like Nutella and hazelnut-flavored coffee. Nutella consumes 25% of the world’s hazelnut supply and a jar is sold every 2.5 seconds.

These global favorites have amassed a dedicated following, contributing to an increased craving for hazelnuts. Moreover, hazelnuts’ health benefits, encompassing nutritional value and heart-friendly properties, have further escalated their demand.

As hazelnut demand escalates, so does the need for a consistent, eco-friendly supply. This creates a golden window of opportunity for investors to venture into hazelnut farming and capitalize on the burgeoning market. By investing in hazelnut farms, you not only tap into escalating demand but also play a role in satisfying the global hunger for hazelnuts.

Benefits of Investing in Hazelnut Farms

Investing in hazelnut farms boasts a plethora of benefits that make it an attractive long-term option. Firstly, hazelnut farms shine for their sustainability. Robust and resilient, hazelnut trees demand minimal maintenance and inputs in comparison to other crops, resulting in a cost-effective and eco-conscious investment choice.

Furthermore, hazelnut farms offer the prospect of impressive profits. Hazelnuts command high prices, often surpassing those of other nuts. Additionally, the longevity of hazelnut trees, which produce nuts for decades, assures a consistent revenue stream, rendering hazelnut farms an alluring investment.

The versatility of hazelnut farming is yet another feather in its cap. Hazelnuts find their way to the market in diverse forms—raw nuts, processed products, even hazelnut oil. This adaptability empowers investors to explore multiple revenue streams, tailoring their approach to market demands.

Digging into Hazelnut Farming Statistics

Let’s delve into compelling statistics to gauge the potential of hazelnut farm investments. The global Hazelnut market size was valued at USD 12624.28 million in 2022 and is expected to expand at a CAGR of 9.14% during the forecast period, reaching USD 21338.85 million by 2028. This surge owes itself to the escalating preference for natural, healthy food and the rising fame of hazelnut-infused spreads and beverages.

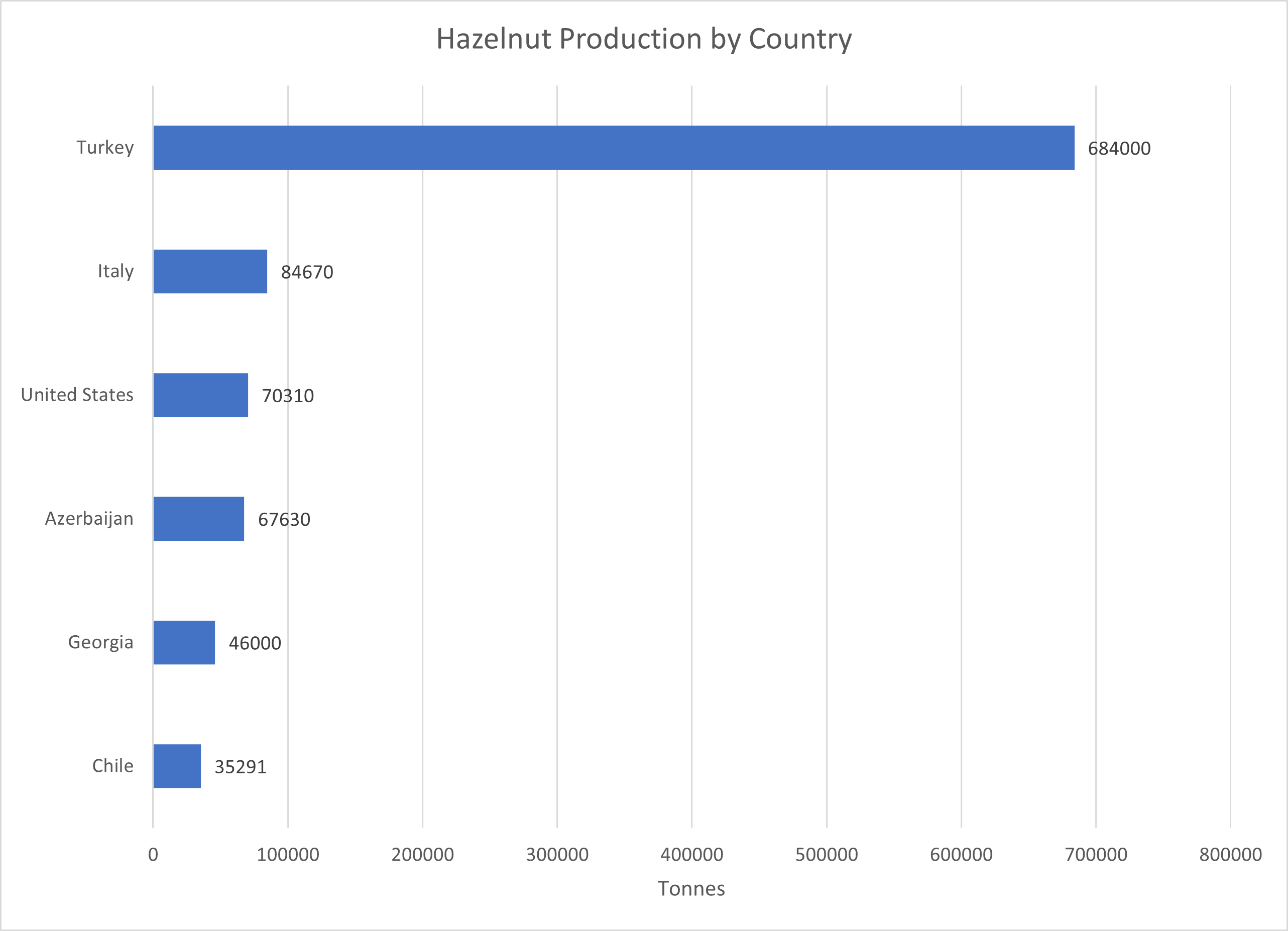

Turkey takes the lead in hazelnut production, contributing to approximately 75% of the worldwide supply. Nevertheless, other players like Italy, the United States, and Georgia are emerging as significant contenders in the hazelnut farming sector. This diversification minimizes supply chain vulnerabilities, mitigating the risk of depending solely on one country for hazelnut production.

Key Considerations Before Investing

Before leaping into hazelnut farm investments, certain factors warrant careful consideration. Begin with understanding the local climate and soil conditions. Hazelnut trees thrive in temperate climes with well-drained soils. Robust research and expert consultation help pinpoint suitable regions for hazelnut cultivation.

Financial planning is paramount, given the upfront investment hazelnut farms entail—land acquisition, tree planting, irrigation systems. Strategic planning eases the transition from investment to profit generation.

Market demand and regional competition are vital factors. Analyzing consumer trends, grasping market dynamics, and identifying potential buyers streamline decision-making, maximizing returns.

Best Practices for Hazelnut Farming Success

Success in hazelnut farming demands adept techniques and practices. These include:

- Pruning, fertilization, and pest management to ensure tree health and productivity.

- Effective irrigation to cater to water-sensitive hazelnut trees, ensuring optimal growth and nut yield.

- Incorporating sustainable practices like organic farming and integrated pest management, appealing to eco-conscious consumers.

Diverse Hazelnut Farm Investment Routes

Investment avenues in hazelnut farms vary, accommodating distinct goals and preferences. Consider these options:

- Purchasing an established farm or orchard, offering immediate market entry with existing infrastructure. Thorough due diligence is essential.

- Investing in hazelnut farmland for greater control and potentially higher returns over a more extended period.

- Collaborating with existing hazelnut farmers or agricultural companies for a more passive role, leveraging their expertise and resources.

Challenges and Triumphs

Like any investment, hazelnut farming is not without challenges. These include:

- Vulnerability of trees to weather and pests, risking yield reduction or crop loss.

- Market volatility, with hazelnut prices oscillating due to global supply, currency rates, geopolitical events.

- The need for patience as trees take years to reach full production capacity.

Real-World Hazelnut Farm Success Stories

The case study focuses on the Ferrero Group’s pursuit of sustainability and supply chain integration, particularly in relation to hazelnuts. The Ferrero Group is a family-based confectionery company that has achieved growth in the competitive chocolate industry through strategic decisions, including aggressive acquisitions. The company aims to double its revenues by 2026 and achieve ambitious corporate social responsibility (CSR) goals, such as 100% sustainability in raw materials supply and processing by 2020.

In recent years, Ferrero acquired the world’s hazelnut supply leader, Oltan, and the British chocolate-maker Thorntons Plc. Despite being the fourth-largest confectionery company globally by net sales in 2015, Ferrero faces challenges in maintaining its leading position and achieving its goals. The chocolate industry has experienced moderate growth, driven by emerging markets like China and India, and consumers’ increasing awareness of ethical concerns.

To remain competitive, Ferrero must address sustainability and CSR goals, particularly related to hazelnuts, as they play a crucial role in its products. The industry’s focus on ethical branding and increasing consumer demand for responsible practices adds complexity to Ferrero’s strategic decisions. The case raises questions about how Ferrero can maintain its position, achieve its goals, and potentially navigate rumors of going public.

Overall, the case study highlights the challenges and opportunities Ferrero faces in its pursuit of sustainability and growth in the chocolate industry, with a focus on hazelnuts as a key ingredient.

Hazelnut Farm Investing A Nutty Good Idea

To wrap up, hazelnut farm investments present an unparalleled opportunity for long-term gains. Given escalating global demand, sustainability, and high profits, hazelnut farms are a prudent choice.

Consider factors like local conditions, market dynamics, and diversification. With diligence and best practices, navigate the hazelnut farming industry effectively. While challenges exist, the potential rewards outweigh them.

If you’re ready to secure your financial future through hazelnut farms, embrace this nutty good idea. Unleash the hidden potential today.

Important Note on Ethical Considerations: The Ferrero Group, discussed as a case study, faced scrutiny for acquiring hazelnut farms linked to a child labor scandal. Ferrero maintains a “Zero tolerance approach” towards child labor, committed to safeguarding children’s rights across its supply chain, as outlined in its Code of Business Conduct.