Introduction

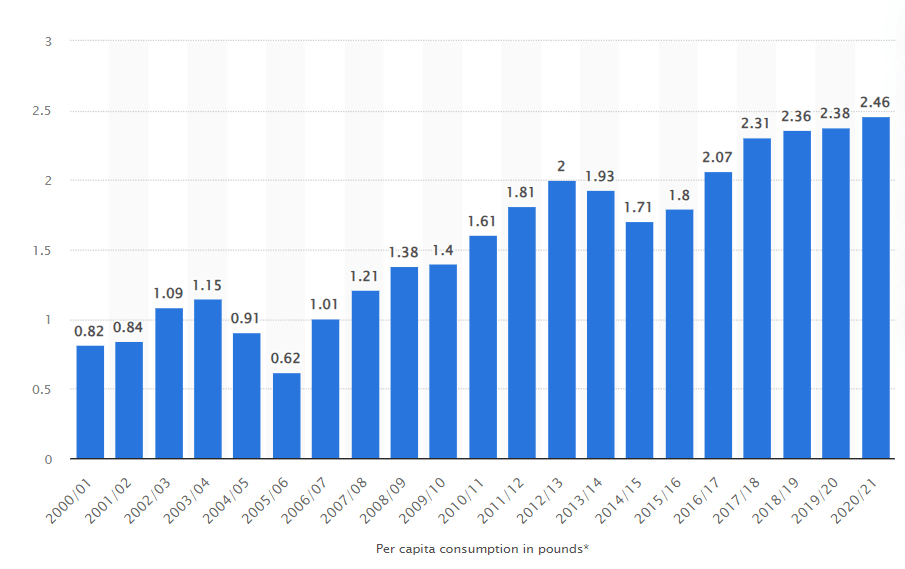

The per capita (per person) almond consumption in the United States has risen by 300% since 2000. This works out to 2.46 pounds of almonds per person which is insane. Subsequently the number of almond farm have grown to match this rising demand.

The USDA-NASS report for 2022 estimated that there 1.64 million acres of almonds farms. This got me thinking with all the new uses for almonds and the surging craze what are investors doing to capitalize on this situation. How can we take advantage of the situation to expand our portfolios into the growing industry.

If you’re someone seeking a lucrative investment in the agriculture sector? Almond farm investments hold immense potential for smart investors like you. In this comprehensive guide, we’ll explore the ins and outs of investing in almond farms, providing you with essential insights to maximize your returns.

Emphasizing the Profitability and Resilience of Almond Farming

Almond farming presents an alluring prospect for investors seeking a stable and profitable venture. The demand for almonds has skyrocketed in recent years, with the US estimated to produce 2 million pounds in 2023. This surge has correspondingly led to a significant expansion in the number of almond farms, totaling 1.64 million acres. These statistics offer a clear picture of the potential profits almond farming can generate.

Imagine vast orchards stretching as far as the eye can see, adorned with lush green almond trees standing tall and healthy. During the harvest season, the orchards are buzzing with activity, as diligent workers collect the ripe almonds that dangle from the branches like precious jewels. Such a picturesque sight signifies the bountiful rewards that await smart investors who venture into almond farming.

A Real-Life Success Story of Almond Farm Investment

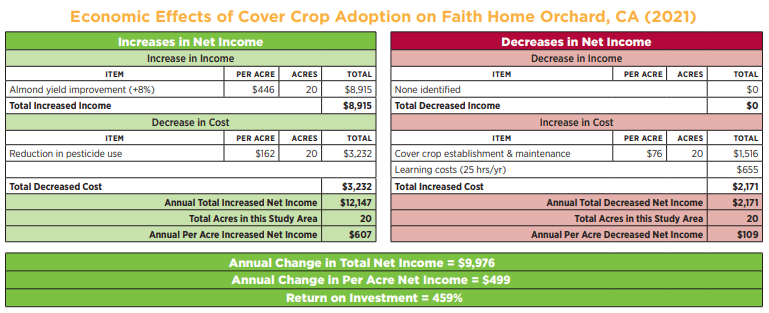

In this soil health case study, we meet Christine and her brother Erich, who have been cultivating almonds since 1999 in Ceres, California. Over the last two decades, they have strived to adopt better farming practices not only to be more sustainable for future generations but also to increase profitability. Christine’s innovative practices include planting cover crops, monitoring soil moisture, and practicing whole orchard recycling.

By integrating cover crops, Christine has not only provided essential forage and habitat for bee pollinators and beneficial insects but has also seen a remarkable 459% increase in their return on investment. Her efforts in soil health have resulted in improved resilience of her almond trees, reduced pesticide usage, enhanced water infiltration, and a reduced carbon footprint.

This case study serves as a beacon of success for almond farm investors, showcasing the positive impacts of sustainable farming practices on both the environment and the bottom line.

Take Action and Capitalize on Almond Farm Investing

As an investor, it’s essential to recognize the potential of almond farm investing and seize the opportunity while it’s ripe. The market dynamics and growing demand for almonds create a favorable environment for maximizing your returns in the agriculture sector. By investing in almond farms, you not only contribute to the booming almond industry but also secure a profitable asset in your portfolio.

Understanding Almond Farming and Harvesting: Addressing Common Questions

As almond farm investing piques your interest, you may wonder about the intricacies of almond farming and harvesting. Understanding these fundamental aspects will provide you with valuable insights into the industry’s dynamics and guide your investment decisions.

How Are Almonds Farmed?

Almond farming involves nurturing almond trees throughout their lifecycle. From planting saplings to managing their growth and health, almond farmers employ specialized techniques to ensure abundant harvests. The process includes irrigation, pest control, and efficient cultivation practices tailored to each almond variety.

How Are Almonds Harvested?

The almond harvesting process is a delicate and time-sensitive endeavor. As the almonds reach peak maturity, mechanical shakers gently vibrate the tree’s branches, causing the ripe nuts to fall onto collection pads. The harvested almonds are then transported to processing facilities for hulling, shelling, and packaging.

Different Investment Options: Almond Farm Stocks and More

In addition to directly owning and operating an almond farm, there are other investment avenues that offer exposure to the lucrative almond industry.

Investing in Almond Farm Stocks

For investors seeking a more hands-off approach, investing in almond farm stocks or agricultural-focused funds can be an appealing option. Almond farm stocks provide indirect exposure to the almond market, allowing investors to benefit from industry growth without the responsibilities of farm management.

Exploring Agribusiness Partnerships

Agribusiness partnerships offer another avenue for investing in almond farms. By teaming up with experienced agricultural operators, investors can participate in the profits generated by the almond farm while entrusting day-to-day operations to professionals.

Almond Farms in California

When it comes to almond farming, California reigns as the leading producer in the United States, boasting the most extensive almond acreage. California produces 80% of the world’s almonds and 100% of the United States commercial supply. The favorable climate, fertile soil, and abundant water resources make California an ideal region for almond cultivation.

Analyzing Regional Advantages

California’s unique advantages contribute to its dominance in almond production. The state’s Mediterranean climate, with mild winters and long, hot summers, provides the perfect environment for almond trees to thrive and produce high-quality nuts. Moreover, California’s extensive irrigation infrastructure ensures water availability during critical stages of almond tree growth.

The Practical Steps for Almond Farm Investment: Guiding the Investors

Investing in almond farms requires a thoughtful approach and a solid plan. As you embark on this exciting investment journey, consider the following practical steps to make informed decisions and maximize your potential for success.

- Research and Due Diligence: Conduct thorough research on almond farming, market trends, and investment opportunities. Seek advice from agricultural experts and professionals to gain valuable insights.

- Identify Suitable Locations: Choose the ideal location for your almond farm investment. Consider factors such as climate, soil quality, and access to water resources to optimize almond tree growth.

- Evaluate Costs and Financing: Assess the costs associated with acquiring land, planting almond trees, and establishing infrastructure. Explore financing options to manage upfront expenses effectively.

- Collaborate with Professionals: Collaborate with experienced almond farmers, agricultural consultants, and financial advisors to ensure a well-informed and successful investment strategy.

- Monitor Market Trends: Stay updated on almond market trends, demand-supply dynamics, and price fluctuations. Market insights will enable you to make strategic decisions for your almond farm.

Conclusion

Investing in almond farms presents an exciting and profitable opportunity for smart investors. The rising demand for almonds and their versatile uses create a promising landscape for growth and prosperity.

Whether you choose to invest directly in an almond farm or explore other investment avenues like almond farm stocks, the key is to seize the opportunity and act decisively. By capitalizing on the potential of almond farming, you position yourself for a fruitful investment journey.

Are you considering investing in almond farms? Have you already experienced success in this thriving industry? Share your thoughts, experiences, and questions in the comments below! Let’s continue the conversation and grow together in almond farm investing.