Grazelog

Your #1 Resource For Farmland Investing!

Farmland REITs

Farmland REITs (Real Estate Investment Trusts) – These are companies that own and operate farmland properties, either for farming or for other purposes such as development or conservation. Farmland investors can buy shares in the REITs, which provide exposure to farmland investment and potential income from rental income, capital gains, or dividends.

Farmland ETFs

Farmland ETFs (Exchange-Traded Funds) – These are investment vehicles that offer exposure to farmland assets through a diversified portfolio of farmland-related stocks and/or REITs. Investors can buy and sell shares in the ETFs on stock exchanges like any other stock.

Farmland investing platforms

These are online marketplaces that connect investors with farmland projects and/or farmers seeking investment. The platforms typically offer a range of investment options, such as equity or debt investments, and may involve a direct or indirect ownership interest in the farmland. Some platforms specialize in specific sectors, crops, or regions, while others offer more diversified portfolios.

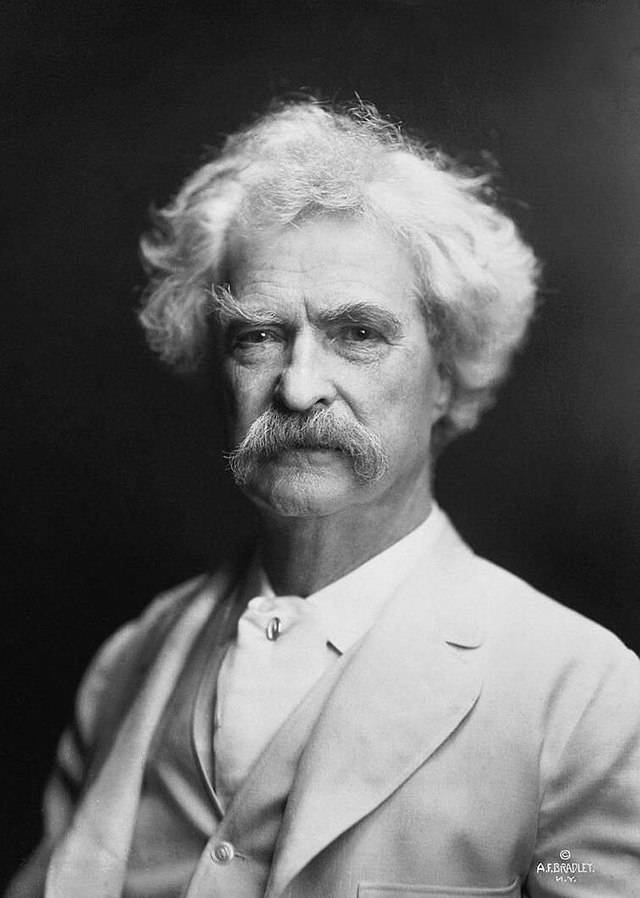

“Buy land, they’re not making it anymore.”

– Mark Twain

“The best investment on Earth is earth.”

– Louis Glickman

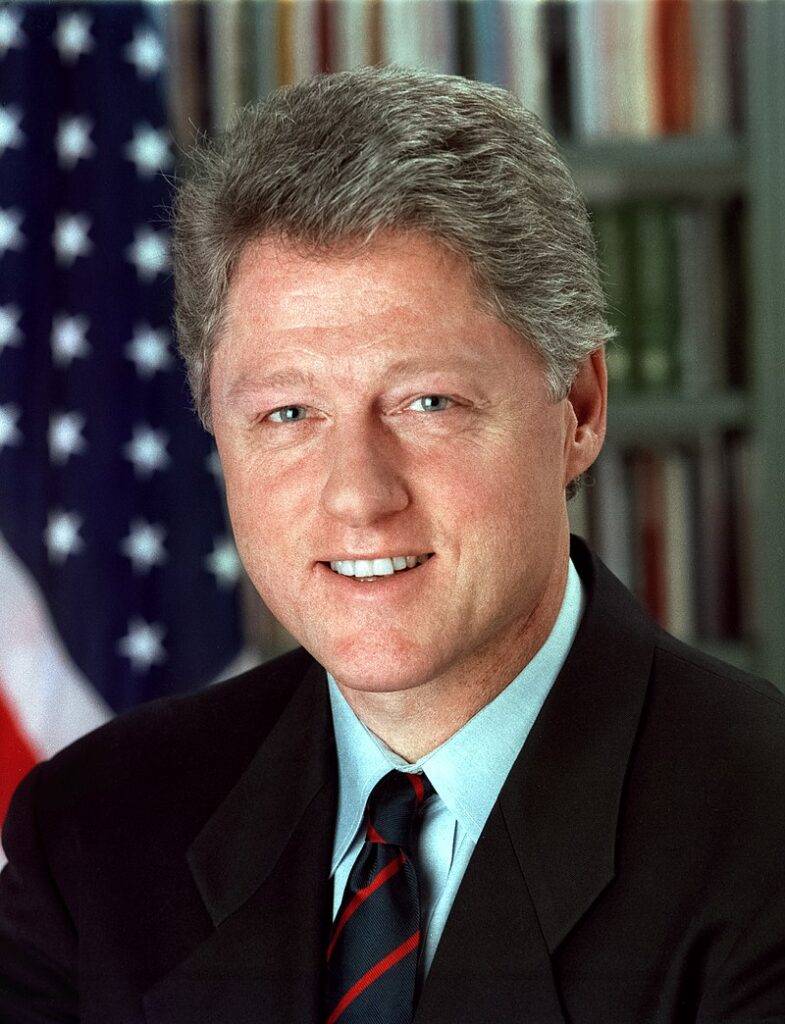

“Farmland is a relatively safe investment with long-term potential. It’s like buying a precious metal with a job.”

– Bill Clinton

Let’s work together on your

farmland investing journey together

Start here to get a detailed look at farmland investing and what your next steps should be on your journey.